VAN

How is Virtual Account Number / VAN API helpful and beneficial for businesses

Softpay

27-12-2022 13:27:38

Business people like to include the latest features to make them attractive to customers. A virtual account refers to a non-physical account. It has become popular among corporate account holders. Many businessmen feel these types of accounts have improved business finances. How can non-physical accounts help a business? While the virtual account may not have a physical presence, they come with the same features as a conventional bank account. Also known as shadow accounts, virtual accounts may not come with the usual workload linked to a standard bank account. But, virtual accounts are easy to identify. The uniqueness of the virtual account makes it easier to identify the transactions from one another. Using the Virtual account number API can enable companies to reconcile real-time payments.

About Virtual Account Number API

Before learning about the API facilitating the use of a virtual account number, you must know how this account number differs from the regular account. As the name suggests, virtual accounts have no physical presence. But, it helps a business as you never have to visit a branch or wait in a long queue to create a bank account. You can easily start an account and complete transactions. Also, you can track the transactions digitally using the virtual account. It can reduce depending on others to complete the process. You can use the VAN API to create an account. You will get a unique number that can help figure out your business transactions. It aids in learning the payment source and the customer (payee) without hassles.

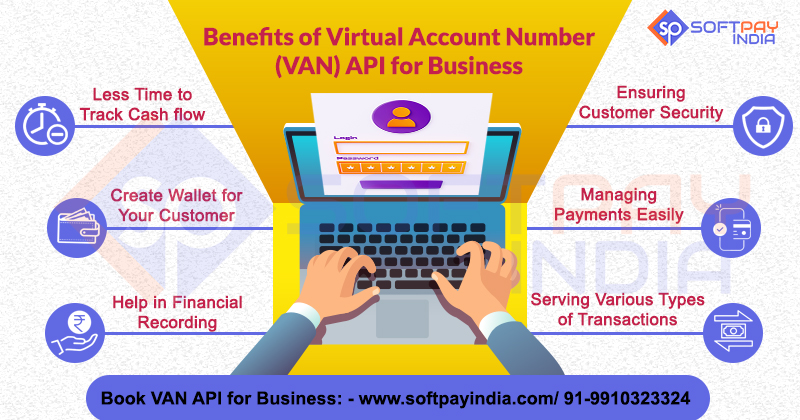

Benefits of Having A Virtual Account Number Using VAN API

As mentioned earlier, the virtual account number works similar manner as the standard one. But, it offers more flexibility than a physical account. You can efficiently reconcile payments from more than one customer using the virtual account. Many companies face difficulties when they must track payments against the order numbers when using the standard account. The high operating costs and increased maintenance needed for conventional accounts also make business people turn to virtual accounts. You can open a virtual account number from a virtual account number API provider with low maintenance and cost. You can manage multiple virtual accounts without hassles. Virtual accounts make it easier to reconcile payments and track them digitally. The physical account uses extended bandwidth via tracking. In comparison, the virtual account can take less time to track cash flow.

Collecting Payment Using Virtual Accounts

According to the regulations by the RBI, any business can accept payment from vendors or customers using a credit/debit card, net banking, or UPI. Customers can also complete payment via online options like RTGS/NEFT/IMPS. Once your company account gets the payment, you get a notification regarding the transaction immediately. Your business can also generate a UPI AR code or a payment link for completing offline transactions. You can share them with your customers to complete the payment process.

Your business can also schedule the payment. It is possible when you wish to collect recurrent payments against the virtual account number provided to the customers. You get the payment on time. You must complete the Know Your Customer (KYC) to aid the business assess the authenticity of the profile of the customers. Your customers can transfer from the virtual account. The account has an authentication layer. It also offers protection from fraud when you complete remote payments.

API From A Trusted Virtual Account Number API Provider

When you choose an API from a trusted VAN API provider, it becomes easy to create unique non-physical accounts. You can create multiple accounts on-demand from the customers and collect the payments. The API can incorporate various methods like RTGS, NEFT, IMPS, and UPI. The virtual accounts created using the API can also provide details regarding the customers, and the amount paid by customers. Virtual accounts can also help with payment reconciliation. A reputed API provider can add features like instant call-back notifications after you receive the payment. The text notification also includes the complete details regarding the remitter. The information can help understand and store the payment source in real-time.

A virtual account may seem similar to a payment gateway. You can use the payment gateway to complete on-time purchases or transactions. But, payment gateways charge one to two percent of the transaction value as fees to the payment gateway provider. The use of a virtual account for one-time or recurring payments has minimal fees compared to a payment gateway.

Access the API From the Best Van API Provider

Softpay India has become the most reputed and trustworthy platform to build the best Virtual account number API. When you get the API services from this trusted platform, you can experience the following benefits:

1. Using the API, you can open virtual accounts for the suppliers or customers without time delay.

2. To create the account for the customers, you require no KYC. The virtual accounts ride on the primary current or savings account.

3. The accounts created by the API may have no expiry date. Your customers never have to pay annual fees or maintenance fees for the virtual account. You can avoid the virtual account-to-virtual account transfer fee.

4. Using the API, you can create virtual accounts supporting UPI/IMPS/RTGS/NEFT transactions.

5. Virtual accounts have no restrictions on money transfers or collections.

6. You can include customized money moving in and out by building your algorithm for your customers.

7. You can send the money received in the virtual account to the primary bank account.

Softpay India develops a controlled and structured API for effective management of data to ensure better financial management. The experts can provide the best customer experience with feature-rich API. The team of professionals with skills uses innovative and sophisticated technology to deliver the best results. The Best Virtual account number API from the transparent platform can streamline payment services. Softpay India provides its customers with a memorable experience using cutting-edge technology to put your business ahead of others in the competitive market. You can choose the security-enabled API for a better experience without the breach of sensitive data. Get in touch with the experts immediately for the best service.